Outperforming Warren Buffet

It was my third year of university (2017), and one of my friends told me about how it’s possible to buy Bitcoin and other cryptocurrencies from some app. He doubled his investments in the last couple of weeks and made his uncle invest some amount, who called him and thanked him for the recommendation. The spark was already kindled.

The infamous scene from the Bollywood movie Phir Hera Pheri.

The infamous scene from the Bollywood movie Phir Hera Pheri.

By next week, I opened an account. I bought my first crypto. On the same day, it rose by 20%. There were some rumors about this project going to partner with a big company. I went ahead and invested more, because you know, “Buy the rumor, sell the news”. And rightly so, the partnership was publicly announced, and I was up 50% in a week!

But what now? I thought. I tried finding more projects, but yikes, they rose a lot already in the last few weeks, I felt I missed the mainstream train. So I put on my detective hat and started my research of “finding great projects that are yet to be discovered” or in other words “undervalued coins”. I sold my old stack and reinvested in a couple of undervalued coins that I thought were promising. Fast forward 6 months, I was up 1000%, yes, 10x. I was also hired for a job next year after I graduate, and I thought to myself, what if I make as much money as my to-be annual salary? There was one issue, even though I was 10x, it wasn’t enough since the principal money that I started with was nominal.

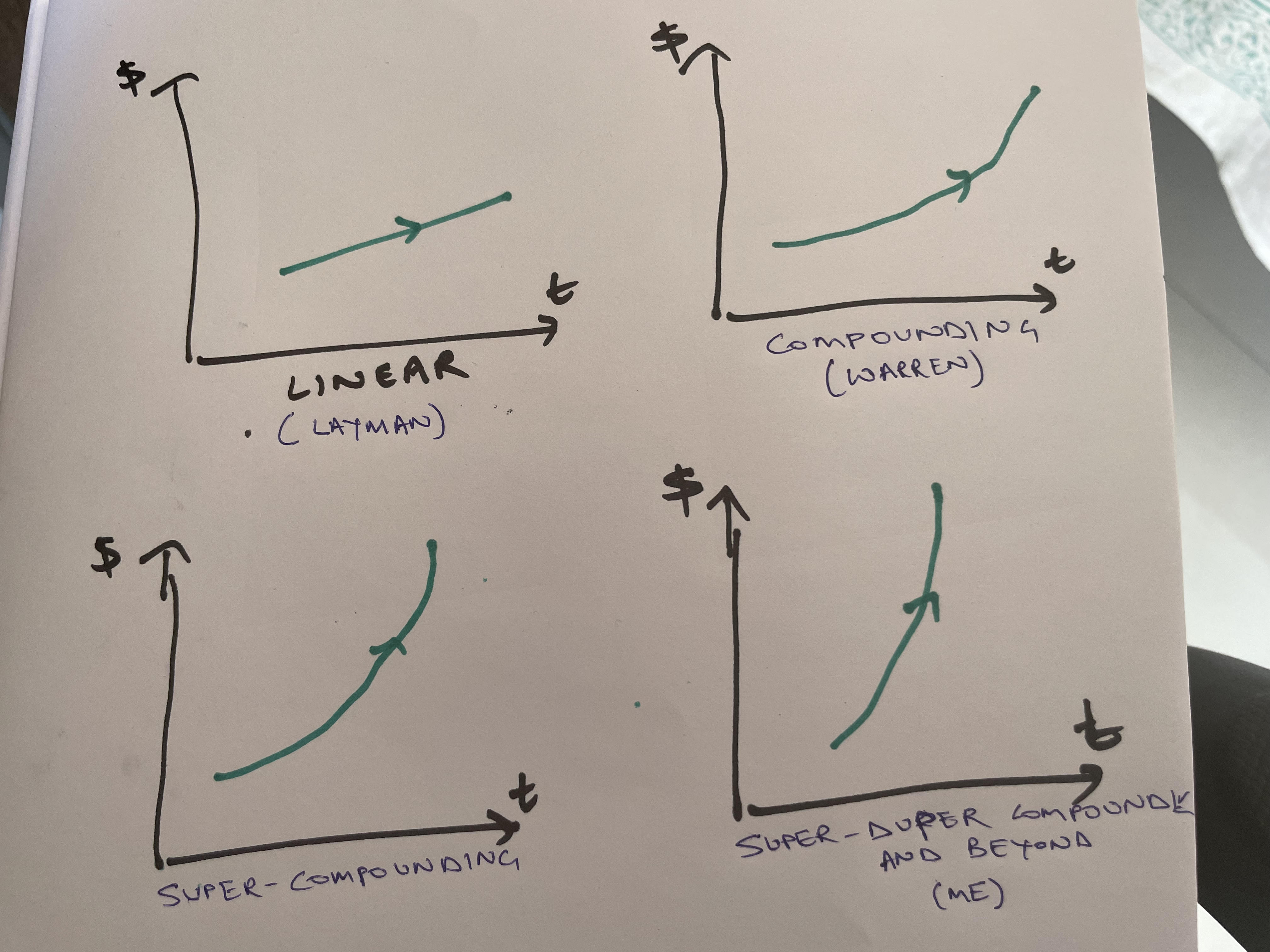

And that’s how my journey in outperforming Warren Buffet started. I watched a lot of Warren Buffet and Charlie Munger’s (his business partner) interviews. And read typical books about money (Rich Dad Poor Dad, Unshakable, 10 pages of The Intelligent Investor). It became obvious that the holy grail was compounding (you invest in something great and stay invested so that time is on your side), but if I were to ditch my job by next year, I’d have to discover principles and strategies that do better than that. I had already found one strategy, which I (now retrospectively) call Super-compounding™. Super-compounding? Yes, it is when you’re fully invested all the time to reap the benefits of compounding, but also keep shuffling between what you’re invested in so that you outperform any single asset. It’s also called re-balancing in a more technical world. The catch with super-compounding is that the benefits of rebalancing should outweigh the transaction costs involved (i.e. brokerage). That wasn’t an issue though, because I realized that upfront.

And I didn’t stop at that of course, what’s better than Super-compounding is Super-duper-compounding™! Instead of waiting for the corpus to compound and grow, you can keep injecting more capital periodically so that it grows faster. The idea was inspired by SIPs (Systematic Investment Plans). To get this going, I’d do freelancing and internships and put the earnings back into crypto.

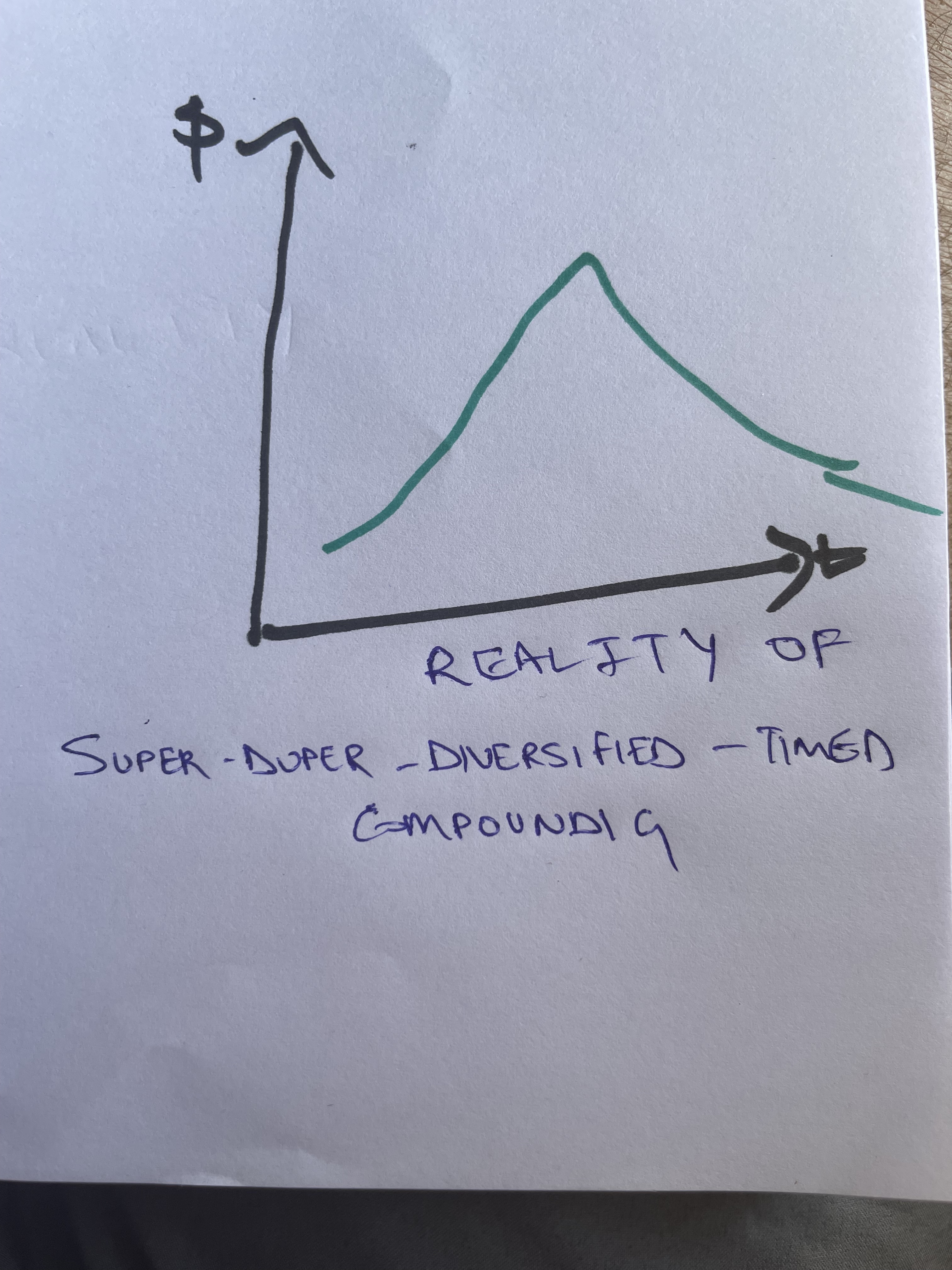

Things went well for a few weeks, I was on track for my financial freedom. My eyes would hurt from staring at the screen and doing freelancing jobs, I didn’t hang out for a long time, but I knew it was only a matter of a few months. I was aware hardly 1% of the world would have exposure to crypto at that time, so I was an “early investor”. Logic would imply it starts getting discussed on mainstream media (CNBC and the likes), and everyone would rush to buy. And at that point, when most of the world is getting into crypto, in the spirit of Super-duper-diversified-compounding™, I’ll start slowly booking profits and invest in something else, maybe those penny stocks or metals like Gold and Copper.

There’s a saying by Vladimir Ilyich Lenin,

There are decades where nothing happens; and there are weeks where decades happen.

The crypto parallel of it is something like

There are weeks where nothing happens; and there are hours where decades happen.

One fine day, I woke up with red eyes, only to see more red in my portfolio. It was down 30%, China threatened to ban miners and the weak hands were pulling out. Smarter people on Reddit mentioned this has happened several times in the history of Bitcoin and it bounced back, which I verified to be true, so yeah, I decided to HODL. It did bounce back in a day! Huh, I should’ve bought more? That’s how the idea of Super-duper-diversified-timed-compounding™ was invented. Why just reshuffle when you can sell a part at a high price and buy when it crashes (Losers will say timing the market is impossible).

On another fine night, while checking my portfolio before going to sleep, I saw another crash (-25%), this time Chinese government formally threatened to ban Bitcoin mining, and smarter people on Reddit labeled it as FUD (Fear, uncertainty, doubt) and so did I. Being opportunistic, I bought some more. 1 week later, another crash happens, Reddit said historically Bitcoin moves up every Christmas, thus it’s just a matter of weeks, buy what you can, so I verified and bought. But the price just kept falling, and falling, and falling. I knew that it was a game of patience too, Rome isn’t built in a day, and strong hands win in the end, so I kept sticking to my super-duper-diversified-timed-compounding strategy.

Then came a time when I ran out of capital to do anything, nothing to diversify, nothing to buy on falls, nothing to shuffle. The idea of making as much corpus as my to-be annual salary seemed like a distant dream. Yikes, I just got thrown off my financial freedom jet, just because a stupid government would spread fear about a technology that makes the world a better place!

Fast forward several months, I’m at my job, I wake up to see my portfolio 20% up from the last day. Then I hesitantly change the time resolution to 1 year, only to realize I’m 76% down overall. And here’s the worst part, If I’d have done nothing, I’d have had 100% of the money (plus that tiny 5% savings interest), and a countless number of day time that I spent researching things for my super-duper-diversified-timed-compounding strategy. Heck, I could’ve just blown that money for travel, it might have cured my mind (pun intended).

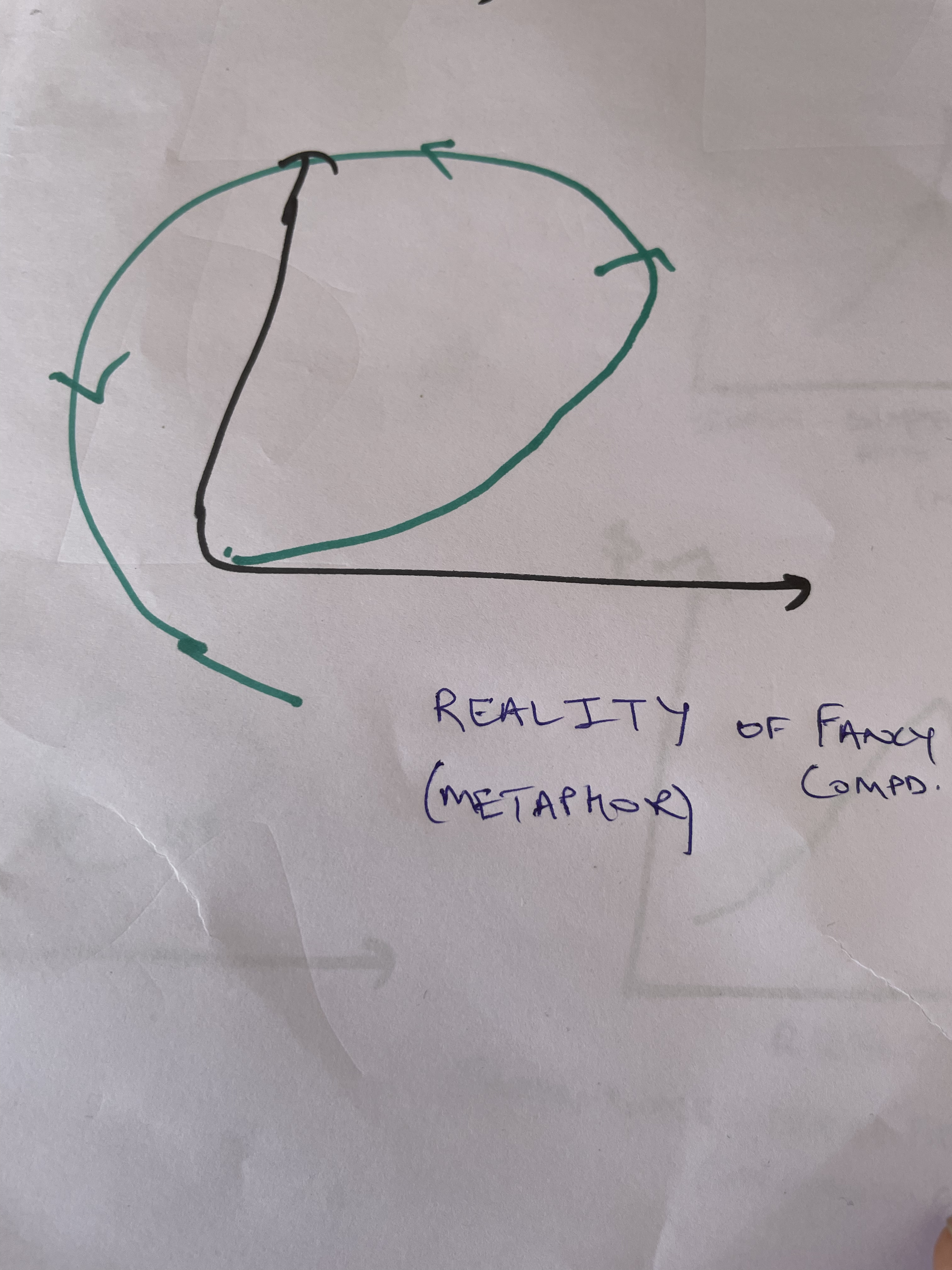

Seeing no hope in crypto at my job, I dabbled with peer-to-peer lending (why put in banks when you can lend to unseen strangers verified by unknown platform and get 20%), stocks (Naval Ravikant, founder of Angelist, more commonly known for his wisdom on Twitter, says one should own equity, so until I’d have my startup, I should buy high growth low market cap stocks for equity exposure), margin trading (why just bet on good assets when I could also “short” the bad ones), commodity trading (when there’s inflation gold-silver rise, and hey, someone on Reddit said we might have a short squeeze. Also where’s all this Copper and Nickel going to come from for the EV revolution), NFT trading (NFTs are stupid, hmm but all of them go up right after they launch, I’ll just buy and exit), and I had similar enthusiasm and experience all the time. In an attempt to outsmart the world, I kept making a fool of myself.

Where did I go wrong?

Do you know that 90% of options traders lose money? That people shouldn’t buy stocks since they are better off with mutual funds. Index funds outperform even expert-managed Mutual funds, so most people are better off holding index funds. I knew all that too, all the way along, but somehow I still managed to mess up. Being stumped after this experience, I resorted to my coding skills to test 100s of super-duper-compounding strategies, myself as well as others as a freelancer, only to realize that none of them works for a sustained period. And yes, the AI also sucks, at least the ones that I could publicly find.

Now looking back, here are a few things I did wrong;

1. Believing that sophistication ⇒ Better returns

Warren says; Investing is simple, but not easy. It’s boring.

I made investing complex, easy, and interesting.

Why? Because I’m young, and wanted to take more risks, since You Only Live Once, why not aim for the moon? Warren says Bitcoin will go to zero, maybe because he doesn’t understand the somewhat sophisticated technology. He also drinks Coke and BigMac every day. I’m a young technologist (and I drink green tea and eat salads every day), who understood how blockchain has value. But yeah, in the quest to outperform Warren, I failed. (The BigMac line is irrelevant, but I can’t resist).

2. Confirmation bias

I selectively picked trading principles and ignored others that didn’t fit my narrative.

3. Believing in “this time it’s different”

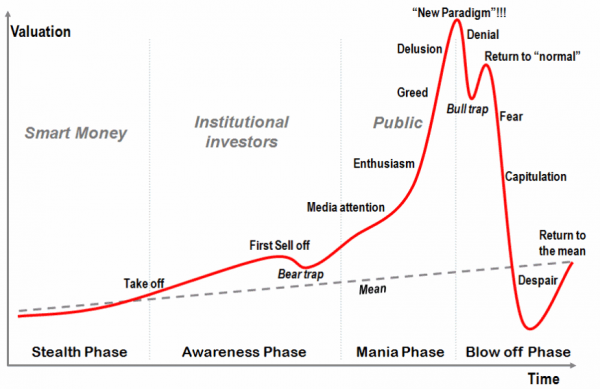

Every time I see an enthusiastic investor these days, it brings a smirk to my face 😏 Everyone feels they’re not “one of us” and “this is different” until they’re corrected. You get hurt even more if you had some Beginner’s luck.

4. Believing that there are bigger fools

There’s a theory known as the Greater Fools theory.

During a market bubble, one can make money by buying overvalued assets and selling them for a profit late, because it will always be possible to find someone willing to pay a higher price.

The only problem is, it takes a certain amount of luck, foresight, and patience to be at the right stage of the fool’s cycle (see below). Most of us are entirely in the mania phase because it’s where the most gains happen, and it’s also where most losses happen.

Source: https://steemit.com/money/@loffer/the-greater-fool-theory

5. The wrong “why” of investing

One of the important further questions I had to ask myself is why did I invest like that? I just wanted to gain enough so that I didn’t have to earn in the future. I wanted to escape the sense of routine that comes with a job. I wanted to be relatively better off, it’s baked into competitive human nature I think. I wanted to get “financial freedom” so that I can spend time doing what I love i.e travel, hangout, play sports and learn music. And have experienced similar to what folks on Instagram and TikTok have.

Here’s what I got wrong. Somewhere amidst all this, I lost track of my north star. I didn’t realize that there were direct ways to reach my “why”, to travel more, hang out more, and follow my hobbies, than the indirect way of making insane money first and then reverting to these activities. I missed a class trip so that I can prepare for my internship and stay on my financial plan. I could’ve easily afforded it. It didn’t occur to me that the whole point of making more money is to do things you want, one of which was to travel with friends.

Most people though, have mortgages, rent, school fees, and college loans, and these FOMO investments seem like the way to get out of a stressful burden quicker than systematic investments.

But, why couldn’t I Travel, Hangout, and follow hobbies anyway? What stopped me?

We don’t ask questions this deep, it’s a logical territory, said my FOMO.

When I first asked this myself, it was uncomfortable. Human life is rarely simple, we have several problems going on at the same time. And we want to fix as many of them as possible. Money, for some reason, seems like the ultimate fixer of problems. It’s easily believable that with “enough money”, most of your problems can be fixed.

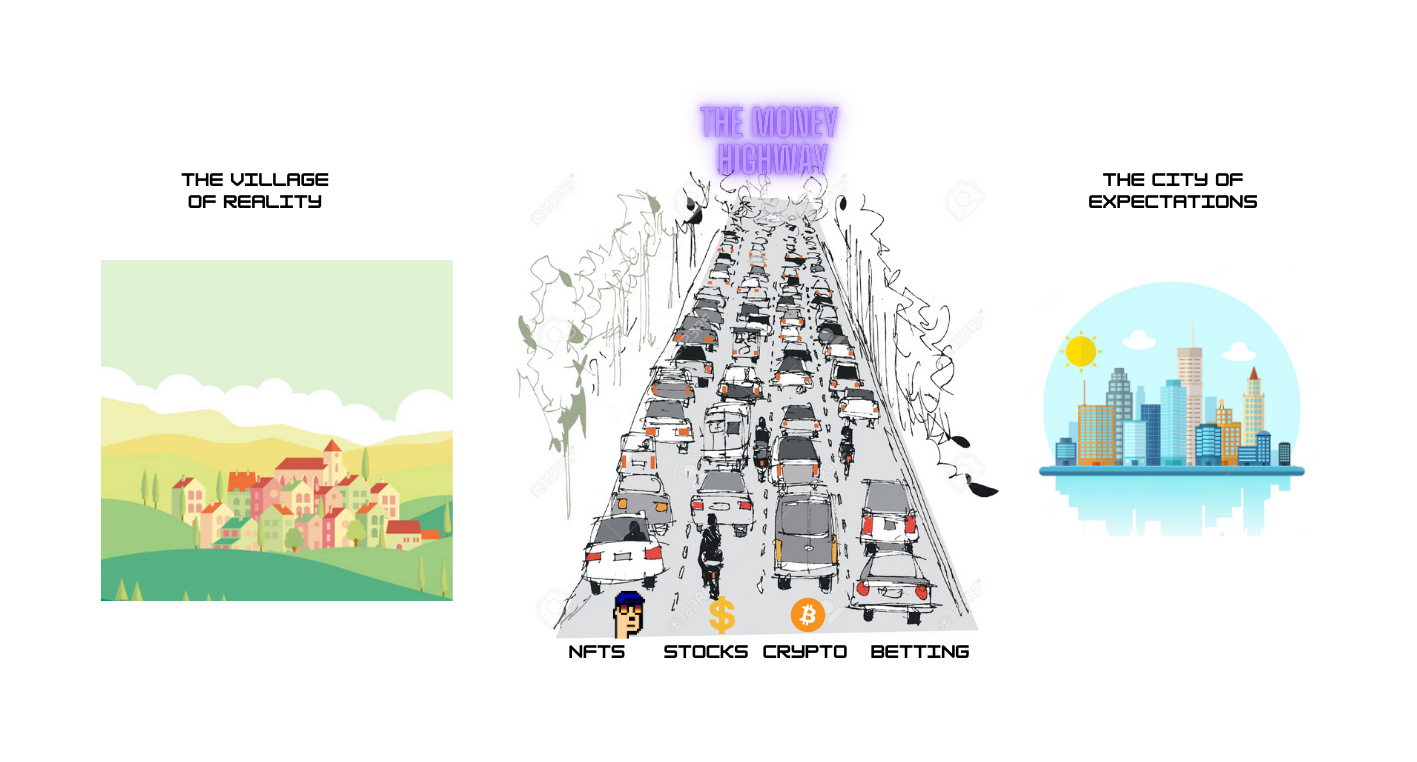

We think that the “Money Highway” is the best way to get from our “Village of Reality” to our “City of Expectations”.

And this might indeed be true, it’s a well-spread idea now that money can solve all your money problems (school, healthcare, food, shelter). So some parts of the City of Expectations can only be or are best reached via The Money Highway. However, the Money Highway is often crowded, almost everyone seems to be on it, and ironically, in kind of a rush. It leaves you at a common entry point in the City of expectations, but you still have to reach specific parts.

The thing that I didn’t realize was making money may not be the only way to solve my non-money problems (travel, hobbies, health, quality of life). That there exists another network of roads, that connects various parts from my Village of Reality to my City of Expectations, the Town Roads!

These roads have several intersections, which makes it confusing to find the path. But these can lead you much faster to the specific parts of the City of Expectations, so the effort may be worth it. For example, if you want to travel a lot, instead of waiting for the moment when you have enough money to resign, maybe find a job that involves traveling (and before you say it’s hard to find such jobs, just try them on the internet for 15 mins). If you aren’t getting time to pursue your hobbies or spend time with your kids, maybe ask for an extra day off in a week, or switch to a different job, even when those scenarios pay less, they get you where you want to be anyway. And in certain cases, gratitude helps too, the village of reality that you live in, might not be that bad after all! (just like mine :).

PS: This is an old post that was sitting incomplete for months. There’s too much that can be said about money, a lot of which is mainstream knowledge these days, so it felt difficult to write something different. However, a half-baked post is still better than an abandoned one, so I decided to make changes here and there and publish it anyway.

In hindsight, I think I’d summarize the takeaway as “sometimes the only thing that’s between your portfolio and growth, is your always-improvising brain”, I’ve found this to be true for most people I’ve discussed the topic with.

That being said, I still actively trade, because a part of investing is about making predictions about the future, which is something I enjoy, hooking money to it (in LIMITED amounts) adds some sports like seriousness to it. There may be opportunities to make life-changing money, but my experiences chasing them have been futile, so that craving has finally stopped for me!